No. 539: June Employment and Unemployment

COMMENTARY NUMBER 539

June Employment and Unemployment

July 5, 2013

__________

Full-Time Employment Plunged by 240,000 in June

Economic Issues Accounted for 75% of Gain in Part-Time Employment

Number of Short-Term Discouraged Workers Increased by 247,000 (corrected)

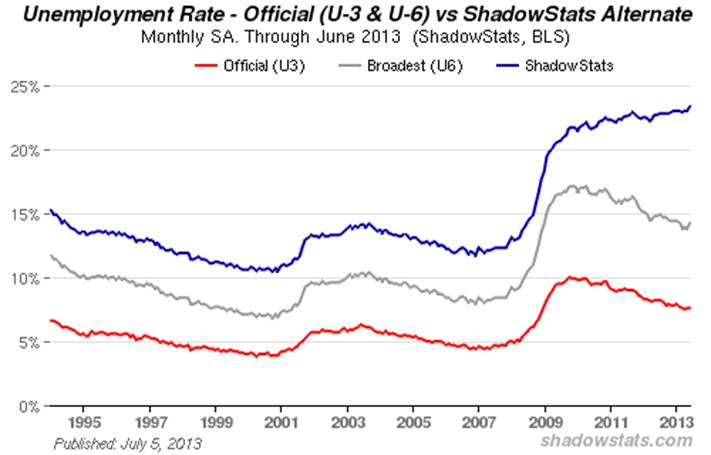

June Unemployment: 7.6% (U.3), 14.3% (U.6), 23.4% (ShadowStats)

Payroll Gains Were Warped Heavily by Inconsistent Seasonal Factors

__________

PLEASE NOTE: A Commentary on Monday, July 8th, will cover full details of today’s (July 5th) June labor data and the preliminary estimate of June broad money supply M3. The next regular Commentary is scheduled for Friday, July 12th, covering the June 2013 producer price index (PPI).

Due to the holiday-delayed release of the Federal Reserve’s weekly monetary statistics, and delays this morning in processing the historical, unofficial monthly revisions to the seasonally-adjusted payroll data, today’s Commentary provides summary detail of June employment and unemployment reporting.

The regular and full June labor and money supply detail, again, will be published in a Commentary on Monday, July 8th, but the preliminary ShadowStats Ongoing M3 Estimate for June 2013 also will be posted tomorrow, July 6th on the Alternate Data tab.

Best wishes to all — John Williams

OPENING COMMENTS AND EXECUTIVE SUMMARY

No Economic Recovery Here. [As noted above, today’s Commentary is a holiday-abbreviated version of the full report that will be published on Monday, July 8th.] The June 2013 report on labor conditions, published this morning (July 5th) by the Bureau of Labor Statistics (BLS) included some harsh indications of economic deterioration in the broader unemployment detail (ShadowStats measure hit a record high for the series), along with heavy seasonal-factor distortions in the headline payroll data.

Broader Unemployment Showed Deteriorating Conditions. The headline unemployment rate (U.3) was unchanged in June 2013 versus May, at 7.6% (also unchanged at the second decimal point at 7.56%). Due to BLS methodologies, however, month-to-month comparisons of seasonally-adjusted household-survey data are not meaningful. Not-seasonally-adjusted, June U.3 rose to 7.8% from 7.3% in May.

The broader U.6 unemployment rate, which includes those marginally attached to the labor force, including short-term (less than one year) discouraged workers, and those working part-time for economic reasons, jumped to a headline 14.3% in June, up from 13.8% in May (unadjusted, it rose to 14.6% from 13.4%). The number of the never-seasonally-adjusted, short-term discouraged workers rose by 247,000 (corrected) in June, to 1,027,000, from 780,000 (corrected) in May. This reflected a surge in people who had been counted as headline unemployed in May, rolling into short-term “discouraged” status in June, net of those rolling out of short-term and into long-term “discouraged” status in June. The deterioration in broader employment appears to have been large enough to be meaningful.

Incorporating the seasonally-adjusted U.6 and the ShadowStats estimate of long-term (more than one year) discouraged workers, the ShadowStats-Alternate Unemployment Measure rose to a series high 23.4% in June, up from 23.0% in May, as shown in the preceding graph (see the Alternate Data tab).

Full-Time Versus Part-Time Employment (Household Survey). Allowing for internal inconsistencies in BLS surveys and the related preparation of its data, headline June employment rose by 160,000, per the household survey, following an inconsistently estimated employment gain of 319,000 in May.

The BLS only accounts for a seasonally-adjusted June employment gain of 120,000, however, when it breaks the detail into full-time versus part-time employment. That 120,000 gain is broken out as drop of 240,000 full-time employed, offset by a gain of 360,000 part-time employed [from Table A-9 of the July 5th BLS press release].

Otherwise counted as a gain of 432,000 part-time employed [Table A-8], 75% of that gain was in the category of “working part time for economic reasons.”

The inconsistent “part-time” counts here reflect various BLS approaches in the handling of answers to its household survey questions (including incomplete or contradictory results), as modeled against its in-house population estimates.

Payroll Employment Gain of 195,000 Was Not Meaningful. In the context of shifting, but not-officially-reported seasonal factors (detail to be published in the July 8th Commentary), the BLS reported headline June payroll employment up by 195,000. Net of prior-period revisions, that monthly gain would have been 265,000. Where the standard 95% confidence interval on headline monthly change in payroll employment reporting is +/- 129,000, circumstances suggest that a much wider confidence interval could be justified. The current numbers continue to be so far out of balance as to be absolutely meaningless, here, due partially to concurrent-seasonal-factor distortions (see Reporting Limitations, below).

The May headline monthly jobs increase was revised to 195,000 (previously 175,000), with April’s revised headline gain at 199,000 (previously 149,000, initially 165,000). Again, the upside seasonal-adjustment distortions here will be discussed in the full report.

The not-seasonally-adjusted, year-to-year change for June 2013 was 1.67%, versus a revised 1.62% (previously 1.60%) in May, and a revised 1.58% (previously 1.56%, initially 1.57%) in April.

In the birth-death model, the monthly upside bias factors appear to have upped, with the June 2013 upside bias at 132,000 versus 122,000 in June 2012. The average monthly upside bias in the last 12 months now is 53,000, versus 52,000 last month.

Reporting Limitations. Details of the various constraints on the quality of the reported labor data will be covered fully in the July 8th missive. Extensive detail in this area, including issues with the concurrent-seasonal-factor adjustments and the birth-death model, previously was provided and is available in Commentary No. 531.

Following are updated graphs for the headline payroll levels and year-to-years rates of change.

[For further detail on the June employment and unemployment, see Commentary No. 540, which will be published on Monday, July 8th, as discussed in the opening note.]

__________

HYPERINFLATION WATCH

Hyperinflation Outlook—Unchanged Summary. [This summary has not been revised from Commentary No. 536 of June 26th]. The comments here are intended as background material for new subscribers and for those looking for a brief summary of the broad outlook of the economic, systemic and inflation crises that face the United States in the year or so ahead.

Background Material. No. 527: Special Commentary (May 2013) supplemented No. 485: Special Commentary (November 2012), reviewing shifting market sentiment on a variety of issues affecting the U.S. dollar and prices of precious metals. No. 485, in turn, updated Hyperinflation 2012 (January 2012)—the base document for the hyperinflation story—and the broad outlook for the economy and inflation, as well as for systemic-stability and the U.S. dollar. Of some use, here, also is the Public Comment on Inflation.

These are the primary articles outlining current conditions and the background to the hyperinflation forecast, and they are suggested reading for subscribers who have not seen them and/or for those who otherwise are trying to understand the basics of the hyperinflation outlook. The fundamentals have not changed in recent years, other than events keep moving towards the circumstance of a domestic U.S. hyperinflation by the end of 2014. Nonetheless, the next, fully-updated hyperinflation report is planned for the near future.

Beginning to Approach the End Game. Nothing is normal: not the economy, not the financial system, not the financial markets and not the political system. The financial system still remains in the throes and aftershocks of the 2008 panic and near-systemic collapse, and from the ongoing responses to same by the Federal Reserve and federal government. Further panic is possible and hyperinflation remains inevitable.

Typical of an approaching, major turning point in the domestic- and global-market perceptions, bouts of extreme volatility and instability have been seen with increasing frequency in the financial markets, including equities, currencies and the monetary precious metals (gold and silver). Consensus market expectations on the economy and Federal Reserve policy also have been in increasing flux. The FOMC and Federal Reserve Chairman Ben Bernanke have put forth a plan for reducing and eventually ending quantitative easing in the form of QE3. The tapering or cessation of QE3 is contingent upon the U.S. economy performing in line with overly-optimistic economic projections provided by the Fed. Initially, market reaction pummeled stocks, bonds and gold.

Underlying economic reality remains much weaker than Fed projections. As actual economic conditions gain broader recognition, market sentiment should shift quickly towards no imminent end to QE3, and then to expansion of QE3. The markets and the Fed are stuck with underlying economic reality, and, eventually, they will have to recognize same. Business activity remains in continued and deepening trouble, and the Federal Reserve—despite currency-market platitudes to the contrary—is locked into quantitative easing by persistent problems now well beyond its control. Specifically, banking-system solvency and liquidity remain the primary concerns for the Fed, driving the quantitative easing. Economic issues are secondary concerns for the Fed; they are used as political cover for QE3. That cover will continue for as long as the Fed needs it.

At the same time, rapidly deteriorating expectations for domestic political stability reflect widening government scandals, in addition to the dominant global-financial-market concern of there being no viable prospect of those controlling the U.S. government addressing the long-range sovereign-solvency issues of the United States government. All these factors, in combination, show the end game to be nearing.

The most visible and vulnerable financial element to suffer early in this crisis likely will be the U.S. dollar in the currency markets (all dollar references here are to the U.S. dollar, unless otherwise stated). Heavy dollar selling should evolve into massive dumping of the dollar and dollar-denominated paper assets. Dollar-based commodity prices, such as oil, should soar, accelerating the pace of domestic inflation. In turn, that circumstance likely will trigger some removal of the U.S. dollar from its present global-reserve-currency status, which would further exacerbate the currency and inflation problems tied to the dollar.

This still-forming great financial tempest has cleared the horizon; its impact on the United States and those living in a dollar-based world will dominate and overtake the continuing economic and systemic-solvency crises of the last eight years. The issues that never were resolved in the 2008 panic and its aftermath are about to be exacerbated. Based on the precedents established in 2008, likely reactions from the government and the Fed would be to throw increasingly worthless money at the intensifying crises. Attempts to save the system all have inflationary implications. A domestic hyperinflationary environment should evolve from something akin to these crises before the end of next year (2014). The shifting underlying fundamentals are discussed in No. 527: Special Commentary; some of potential breaking crises will be expanded upon in the next revision to the hyperinflation report.

Still Living with the 2008 Crisis. There never was an actual recovery following the economic downturn that began in 2006 and collapsed into 2008 and 2009. What followed was a protracted period of business stagnation that began to turn down anew in second- and third-quarter 2012 (see new detail in Commentary No. 530). The official recovery seen in GDP has been a statistical illusion generated by the use of understated inflation in calculating key economic series (see No. 527: Special Commentary, Commentary No. 528 and Public Comment on Inflation). Nonetheless, given the nature of official reporting, the renewed downturn likely will gain recognition as the second-dip in a double- or multiple-dip recession.

What continues to unfold in the systemic and economic crises is just an ongoing part of the 2008 turmoil. All the extraordinary actions and interventions bought a little time, but they did not resolve the various crises. That the crises continue can be seen in deteriorating economic activity and in the ongoing panicked actions by the Federal Reserve, where it still proactively is monetizing U.S. Treasury debt at a pace suggestive of a Treasury that is unable to borrow otherwise.

Before and since the mid-April rout in gold prices, there had and has been mounting hype about the Fed potentially pulling back on its “easing” and a coincident Wall Street push to talk-down gold prices. As discussed in No. 527: Special Commentary, those factors appeared to be little more than platitudes to the Fed’s critics and intensified jawboning to support the U.S. dollar and to soften gold, in advance of the still-festering crises in the federal-budget and debt-ceiling negotiations. Despite orchestrated public calls for “prudence” by the Fed, and Mr. Bernanke’s press conference following the June 19th FOMC meeting, the underlying and deteriorating financial-system and economic instabilities have self-trapped the Fed into an expanding-liquidity or easing role that likely will not be escaped until the ultimate demise of the U.S. dollar.

Further complicating the circumstance for the U.S. currency is the increasing tendency of major U.S. trading partners to move away from using the dollar in international trade, such as seen most recently in the developing relationship between France and China (see No. 527: Special Commentary).

The Fed’s recent and ongoing liquidity actions themselves suggest a signal of deepening problems in the financial system. Mr. Bernanke admits that the Fed can do little to stimulate the economy, but it can create systemic liquidity and inflation. Accordingly, the Fed’s continuing easing moves appear to have been primarily an effort to prop-up the banking system and also to provide back-up liquidity to the U.S. Treasury, under the political cover of a “weakening economy.” Mounting signs of intensifying domestic banking-system stress are seen in softening annual growth in the broad money supply, despite a soaring pace of annual growth in the monetary base, and in global banking-system stress that followed the crisis in Cyprus and continuing, related aftershocks.

Still Living with the U.S. Government’s Fiscal Crisis. Again, as covered in No. 527: Special Commentary, the U.S. Treasury is in the process of going through extraordinary accounting gimmicks, at present, in order to avoid exceeding the federal-debt ceiling. Early-September appears to be the deadline for resolving the issues tied to the debt ceiling, including—in theory—significant budget-deficit cuts.

Both Houses of Congress recently put forth outlines of ten-year budget proposals that still are shy on detail. The ten-year plan by the Republican-controlled House proposes to balance the cash-based deficit as well as to address issues related to unfunded liabilities. The plan put forth by the Democrat-controlled Senate does not look to balance the cash-based deficit. Given continued political contentiousness and the use of unrealistically positive economic assumptions to help the budget projections along, little but gimmicked numbers and further smoke-and-mirrors are likely to come out of upcoming negotiations. There still appears to be no chance of a forthcoming, substantive agreement on balancing the federal deficit.

Indeed, ongoing and deepening economic woes assure that the usual budget forecasts—based on overly-optimistic economic projections—will fall far short of fiscal balance and propriety. Chances also remain nil for the government fully addressing the GAAP-based deficit that hit $6.6 trillion in 2012, let alone balancing the popularly-followed, official cash-based accounting deficit that was $1.1 trillion in 2012 (see No. 500: Special Commentary).

Efforts at delaying meaningful fiscal action, including briefly postponing conflict over the Treasury’s debt ceiling, bought the politicians in Washington minimal time in the global financial markets, but the time has run out and patience in the global markets is near exhaustion. The continuing unwillingness and political inability of the current government to address seriously the longer-range U.S. sovereign-solvency issues, only pushes along the regular unfolding of events that eventually will trigger a domestic hyperinflation, as discussed in Commentary No. 491.

U.S. Dollar Remains Proximal Hyperinflation Trigger. The unfolding fiscal catastrophe, in combination with the Fed’s direct monetization of Treasury debt, eventually (more likely sooner rather than later) will savage the U.S. dollar’s exchange rate, boosting oil and gasoline prices, and boosting money supply growth and domestic U.S. inflation. Relative market tranquility has given way to mounting instabilities, and severe market turmoil likely looms, despite the tactics of delay by the politicians and ongoing obfuscation by the Federal Reserve.

This should become increasingly evident as the disgruntled global markets begin to move sustainably against the U.S. dollar. As discussed earlier, a dollar-selling panic is likely this year—still of reasonably high risk in the next month or so—with its effects and aftershocks setting hyperinflation into action in 2014. Gold remains the primary and long-range hedge against the upcoming debasement of the U.S. dollar, irrespective of any near-term price gyrations in the gold market.

The rise in the price of gold in recent years was fundamental. The intermittent panicked selling of gold has not been. With the underlying fundamentals of ongoing dollar-debasement in place, the upside potential for gold, in dollar terms, is limited only by its inverse relationship to the purchasing power of the U.S. dollar (eventually headed effectively to zero). Again, physical gold—held for the longer term—remains as a store of wealth, the primary hedge against the loss of U.S. dollar purchasing power.

__________

WEEK AHEAD

Weaker Economic and Stronger Inflation Data Are Likely for June and Beyond. [This Week Ahead section is unchanged from the prior Commentary.] In the context of mixed, but generally weak May economic reporting, the data into June and beyond likely will disappoint a still overly-optimistic consensus view of the broad economy. Separately, with energy-inflation related seasonal-adjustment factors swinging to the plus-side in June, combined with stable oil and gasoline prices for the month, higher inflation reporting is likely in June and the months ahead.

Going forward, reflecting the still-likely negative impact on the U.S. dollar in the currency markets from continuing QE3 and the still-festering fiscal crisis/debt-ceiling debacle (see Hyperinflation Outlook), reporting in the ensuing months and year ahead generally should reflect much higher-than-expected inflation (see No. 527: Special Commentary).

Where expectations for economic data in the months and year ahead should tend to soften, weaker-than-expected economic results still remain likely, given the intensifying structural liquidity constraints on the consumer. Increasingly, previous estimates of economic activity should revise lower, particularly in upcoming annual benchmark revisions, as has been seen already in industrial production, new orders for durable goods, retail sales, the trade deficit and construction spending. The big revision event, though, remains the July 31st comprehensive overhaul, benchmark revision and redefinition of the GDP back to 1929. A ShadowStats estimate of the likely net shift in GDP reporting patterns (generally slower growth in recent years) will be published before that revision.

Reporting Quality Issues and Systemic Reporting Biases. Significant reporting-quality problems remain with most major economic series. Headline reporting issues are tied largely to systemic distortions of seasonal adjustments. The data instabilities were induced by the still-ongoing economic turmoil of the last six-to-seven years, which has been without precedent in the post-World War II era of modern economic reporting. These impaired reporting methodologies provide particularly unstable headline economic results, where concurrent seasonal adjustments are used (as with retail sales, durable goods orders, employment and unemployment data), and they have thrown into question the statistical-significance of the headline month-to-month reporting for many popular economic series.

With an increasing trend towards downside surprises in near-term economic reporting, recognition of an intensifying double-dip recession should continue to gain. Nascent concerns of a mounting inflation threat, though muted, increasingly have been rekindled by the Fed’s monetary policies. Again, though, significant inflation shocks are looming in response to the fiscal crisis and a likely, severely-negative response in the global currency markets against the U.S. dollar.

The political system and Wall Street would like to see the issues disappear, and the popular media do their best to avoid publicizing unhappy economic news, putting out happy analyses on otherwise negative numbers. Pushing the politicians and media, the financial markets and their related spinmeisters do their best to hype anything that can be given a positive spin, to avoid recognition of serious problems for as long as possible. Those imbedded, structural problems, though, have horrendous implications for the markets and for systemic stability, as discussed in Hyperinflation 2012, No. 485: Special Commentary and No. 527: Special Commentary.

Producer Price Index—PPI (June 2013). The June 2013 PPI is scheduled for release on Friday, July 12th, by the Bureau of Labor Statistics (BLS). With minimally-mixed energy prices in the context of likely positive energy-price related seasonal factors, and with upside food and “core” inflation, the headline June PPI should show solid upside aggregate price movement for the month.

Depending on the oil contract followed, oil prices, on average, were down by 1.1-percentage point or up by 0.4-percentage point for the month of June, with retail gasoline up by 0.4-percentage point. Accordingly, with roughly 2-percentage points upside seasonal adjustments to energy prices, positive seasonally-adjusted energy inflation should put a positive base under the headline PPI finished goods number. The result likely will be near a developing positive consensus.

__________